As a reminder, the W-8 Form is a legal document required by the Internal Revenue Service (IRS) in the United States that allows foreign investors to claim special tax treaty benefits, including a reduced withholding tax rate. To trade on the US market, Selfwealth requires that you have a valid W-8 form.

Your W-8BEN/W-8BEN-E form will expire on December 31st of the third year after submission. For example, if you submit the form in March 2023, a renewal must be done before December 31st, 2026. This means that your access to trading on your US account will be temporarily suspended until you have renewed your form.

Renewing your form is an IRS Tax requirement and is crucial to maintain access to your US portfolio and ensure uninterrupted trading.

As a reminder, failing to renew your form on time will result in a halt to receiving dividends, a increase in your tax rate to 30%, and the inability to trade in the US market.

Please ensure that you have renewed the W-8BEN form on all of your Portfolio's that have US trading enabled.

Renewing is simple. Log in to your Selfwealth account via a browser and follow the renewal prompts.

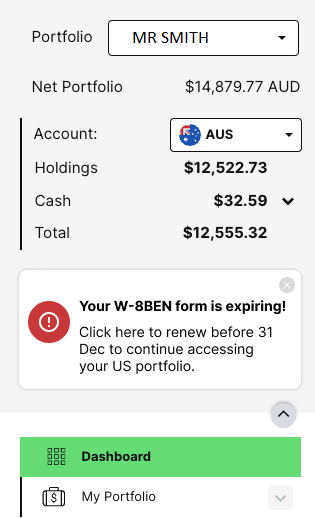

You will see the below notification on each Portfolio page in which you have enabled US trading:

Individual and Joint Accounts (W-8BEN)

Your information will be pre-populated based on your account information on record with Selfwealth.

Please log in to your Selfwealth account on a browser and update your details (if required) via the Settings page before completing the W-8BEN form.

Please note: if you have a joint account, each holder must complete and electronically sign a separate W-8BEN form to continue trading US shares. If one party does not, both parties' access will be revoked.

If the secondary joint account holder has never logged in, they can attempt to use the "Forgot my Password" function to log in and proceed. Alternatively, if they do not have a login and/or are unable to electronically sign the form, the primary account holder will have to download a manual form here, scan and send the completed form to us securely here >

SMSF, Trust and Company Accounts (W-8BEN-E)

If you have an SMSF, Trust or Company account, you will have to renew your

W-8BEN-E for each entity. Signatures must be in wet ink, as digital signatures are not accepted. Please also note that only one signatory per entity must sign the form.

You can access the form here.

Alternatively, you can log into your Selfwealth account, navigate to Settings → Documents and Forms, and download the "W-8BEN-E Form - Entities (SMSFs, Trusts and Corporations)."

Then please scan and send the completed form to us securely here >

Can I get assistance completing the W-8BEN/W-8BEN-E form?

Please note that Selfwealth is unable to provide you with advice regarding your tax status and this declaration. If you need assistance completing your W-8BEN-E form, please see the below resources:

Download Selfwealth's guide on completing the W-8BEN-E form

Download the IRS Instructions on completing the W-8BEN-E Form

If you are still unsure about your tax status after viewing the above resources, you should contact your tax adviser for advice and further information.