A 'dividend' is a distribution of profits to eligible shareholders, usually paid out on a regular basis. When a company pays a dividend, you can elect to receive it in cash or to have the dividend automatically reinvested on your behalf into more shares in that company. Not all funds or companies pay dividends, and not all companies or funds offer dividend reinvestment.

Dividends for Australian shares are managed by a 'share registry', which is an organisation contracted by the security issuer to manage the registry of shareholders for that company.

For more information on share registries, and how to find out which one manages your holding click here.

Please note: this article discusses dividends for Australian holdings. For information on receiving dividends for your international holdings please click here.

How do I receive my ASX dividends as cash?

There are two ways of receiving Australian dividends as cash. The method you use will depend on whether you started your trading account application before or after the 25th of July 2022.

Applications Started After 25th July 2022

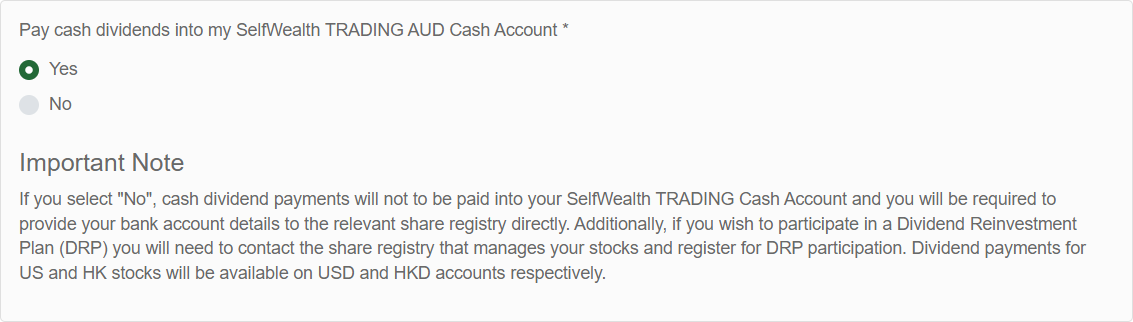

If you started your application after the 25th of July 2022, you can elect to receive all Australian dividends as cash into your Selfwealth AUD cash trading account during the application process (shown below).

If you select the 'Yes' option, then each time you purchase shares you may receive a communication from the share registry managing that holding to advise your dividend payment details have been updated.

If you wish to review your Selfwealth cash account details to confirm that they match the bank details used by the share registry, you can do so by following the instructions in this help centre article.

Please note: if you wish to participate in a 'Dividend Reinvestment Plan' (DRP) you will need to instruct the share registry directly.

Applications Started Before 25th July 2022

If you started your application before the 25th of July 2022, then you must provide dividend election details to the share registry directly for each of your holdings. You can provide the share registry with your Selfwealth cash account details to receive dividend payments directly into your Selfwealth AUD cash trading account.

For more information on how to locate the relevant share registry for your holding, click here.

How do I automatically reinvest my ASX dividends?

A 'Dividend Reinvestment Plan' (DRP) instructs a company or share registry to reinvest any dividends paid to, the shareholder, as new shares. If you wish to participate in DRP you will need to contact the share registry that manages your stocks and register for DRP participation.

When this happens, the share registry will advise Selfwealth that you have more shares or units and your Selfwealth account will update to reflect this. It may take up to one week for the shares to reach your Selfwealth account once they are issued.