Please note: this article applies to the Selfwealth Adviser Platform, and refers to functionality that is only available to financial advisers.

You can create any number of model portfolios in the Selfwealth Adviser platform, providing a quick and scalable solution to set up portfolios matching various risk profiles and portfolio objectives.

You can then apply these models to your clients' accounts as required, and automatically submit the required buy/sell orders using the 'Portfolio Alignment' tool.

The model portfolio functionality also includes detailed historical performance and portfolio analysis, including on models which are not associated with client accounts, making it simple to test, analyse and compare differing investment strategies.

How do I create or edit a model portfolio?

Adding a Model Portfolio

Model portfolios are managed via the 'Model Portfolios' menu, accessed via the left-hand nav bar.

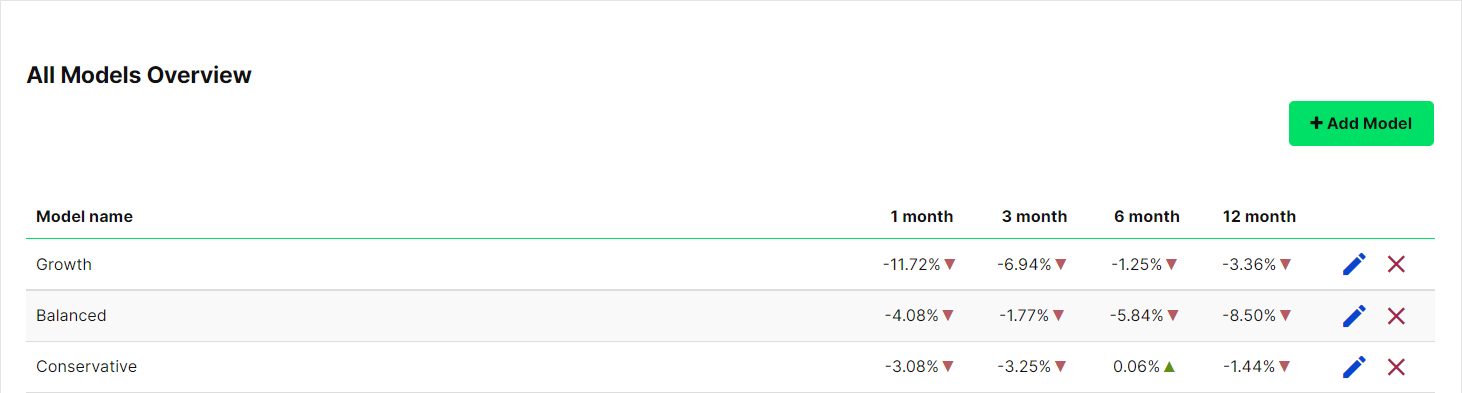

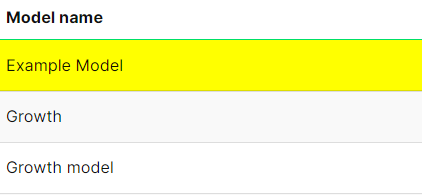

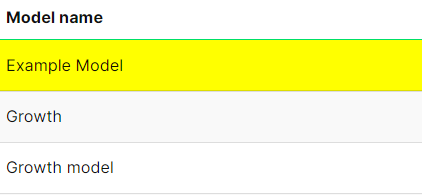

Clicking this link will bring up a list of all the model portfolios that you manage. To create a new model portfolio click + Add Model.

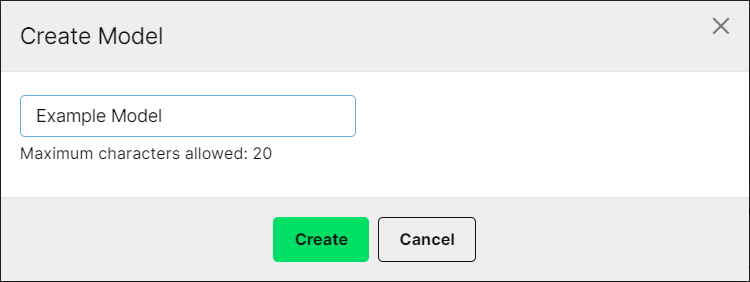

Next, enter a name for your model and click Create.

The model portfolio should appear in the list below. You can now edit the portfolio to add some holdings to it.

Editing Model Portfolio

To edit the model portfolio, go to the 'Model Portfolios' screen and click on the 'model name'.

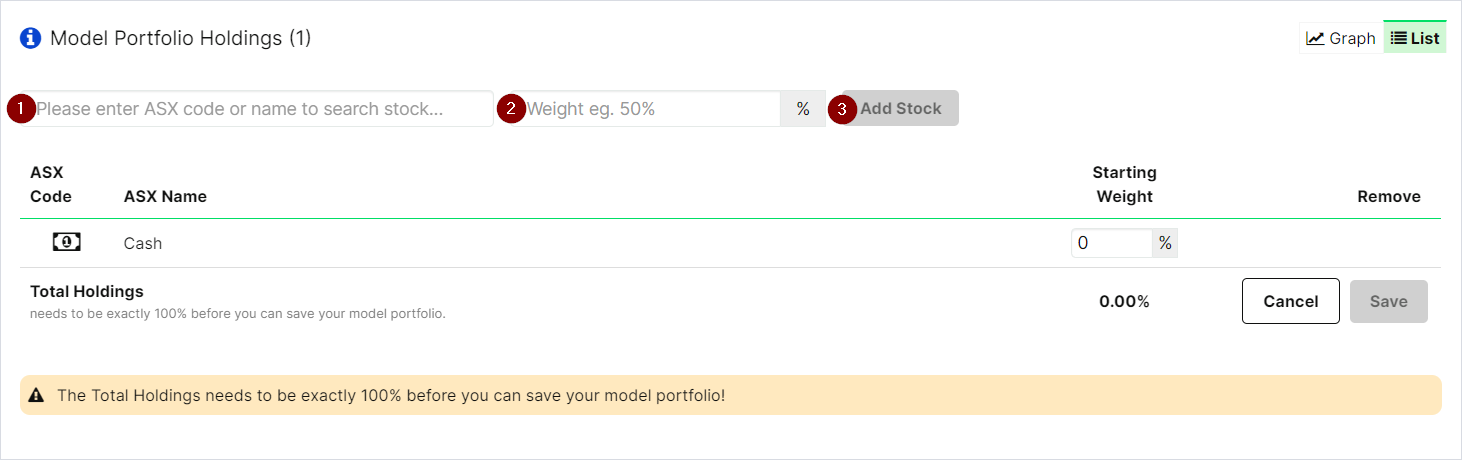

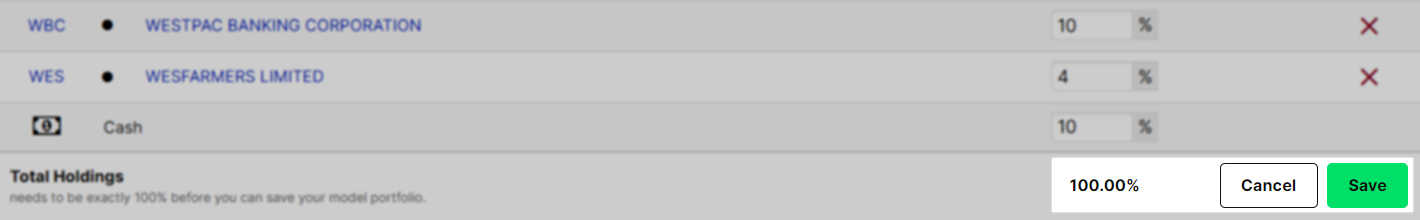

Under 'Model Portfolio Holdings', you will see a list of holdings in the model portfolio and their weighting (in this case the only holding is 'cash'). To add a holding, enter the stock code in the search box (1), enter your desired weighting (2) and click Add Stock (3).

Once you've added holdings, you can adjust the weighting as desired by changing the 'Starting Weight' (if you can't change the weighting, click Adjust Stocks Weight).

When you're happy with your model portfolio, click Save to commit the changes (your total weighting must be 100% to save your changes).

When you're happy with your model portfolio, click Save to commit the changes (your total weighting must be 100% to save your changes).

Delete or Rename a Model Portfolio

You can rename a model portfolio from the 'Model Portfolios' screen by clicking the ( ![]() ) icon next to the model portfolio name. To delete a model portfolio click the (

) icon next to the model portfolio name. To delete a model portfolio click the ( ![]() ) icon.

) icon.

How do I align a client's account to a model portfolio?

Assigning a Model Portfolio to a Client

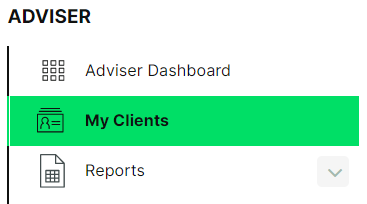

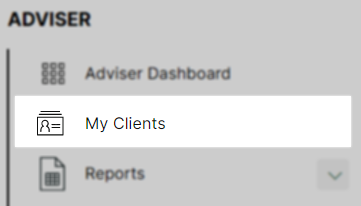

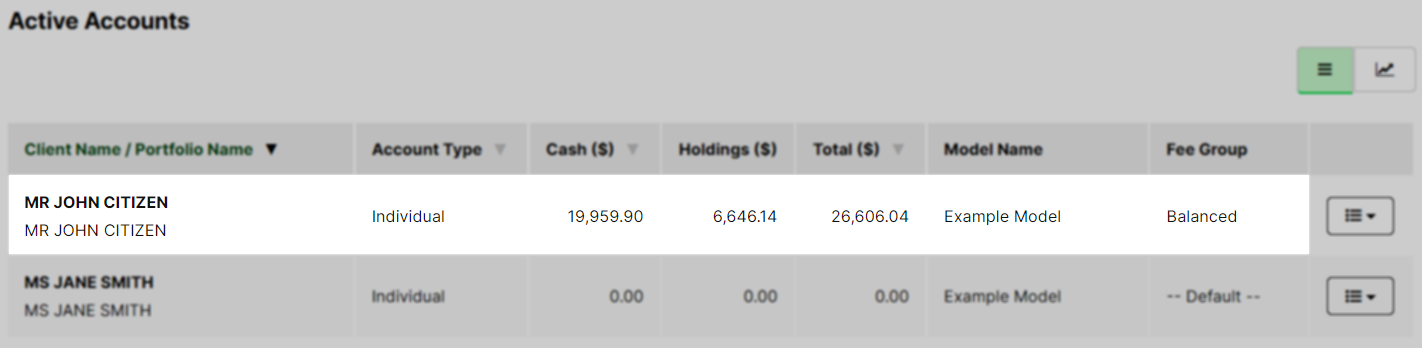

Once you've created a model, you can assign it to a client account. First, click My Clients on the left-hand navigation bar.

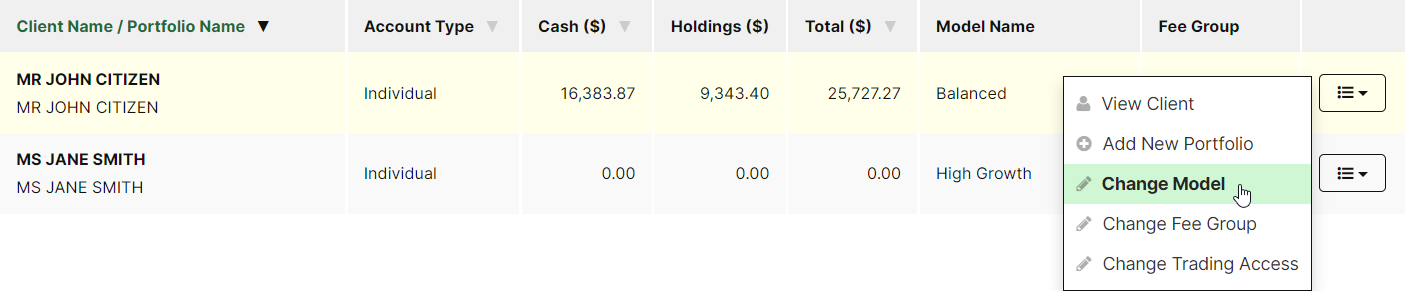

This will bring up a list of the clients you're managing. Locate the client you wish to apply the model to, then click the ( ![]() ) icon next to the client name and select Change Model.

) icon next to the client name and select Change Model.

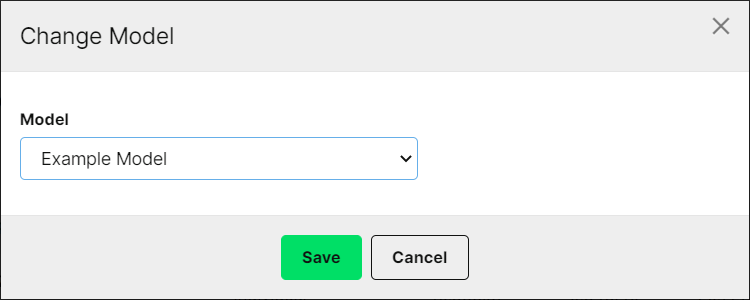

Select the model you want using the drop-down menu, then click Save to apply the changes.

Once you've selected a model, you will need to use the 'Portfolio Alignment Tool' to align the client's portfolio to the model.

Using the Portfolio Alignment Tool

The Portfolio Alignment Tool creates the necessary buy and sell orders to align the client's portfolio to their assigned model.

The tool works by taking the client's total portfolio value, and dividing this up between orders that will establish holdings in-line with the model portfolio weightings. Any holdings which are not part of the model portfolio will be sold entirely.

For example, if a particular stock is weighted at 10% in the model portfolio and the client account has a total value of $50,000, using the portfolio alignment tool will generate a buy order for $5,000 worth of that stock. If the client already owns $10,000 of that particular stock, then using the portfolio alignment tool will generate a sell order for $5,000 of that stock, to bring the total weighting in-line with the model.

To align the client's portfolio to the model portfolio, follow the below steps:

Click My Clients on the left-hand navigation bar.

Next, click the name of the client you wish to apply the model portfolio to.

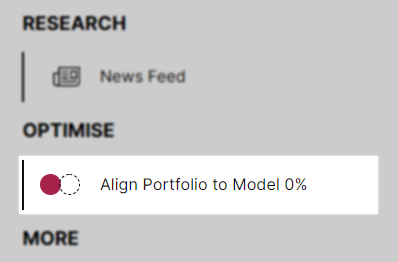

The client name should now be displayed on the left-hand navigation bar. Confirm you've selected the desired account, then click Align Portfolio to Model (you may need to scroll down to see this option).

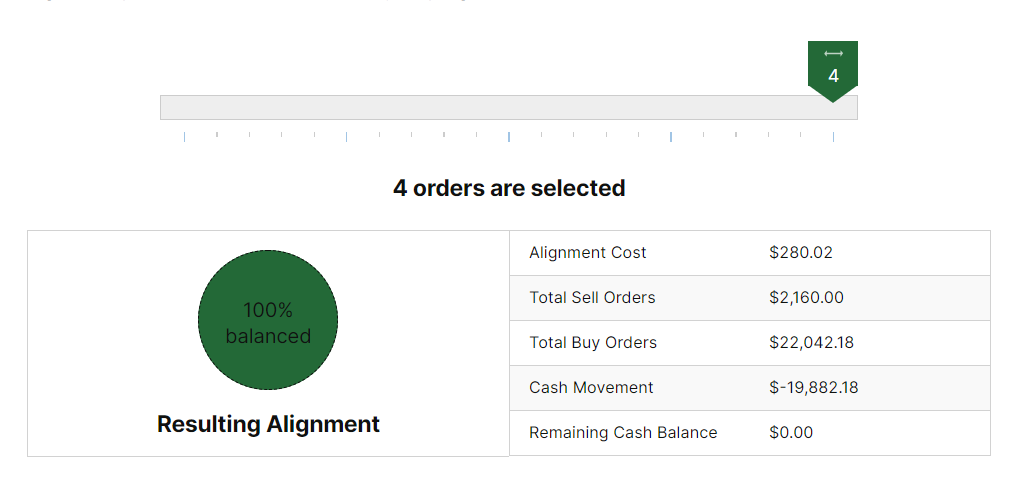

Drag the alignment slider all the way to the right. Your 'Resulting Alignment' should be 100%.

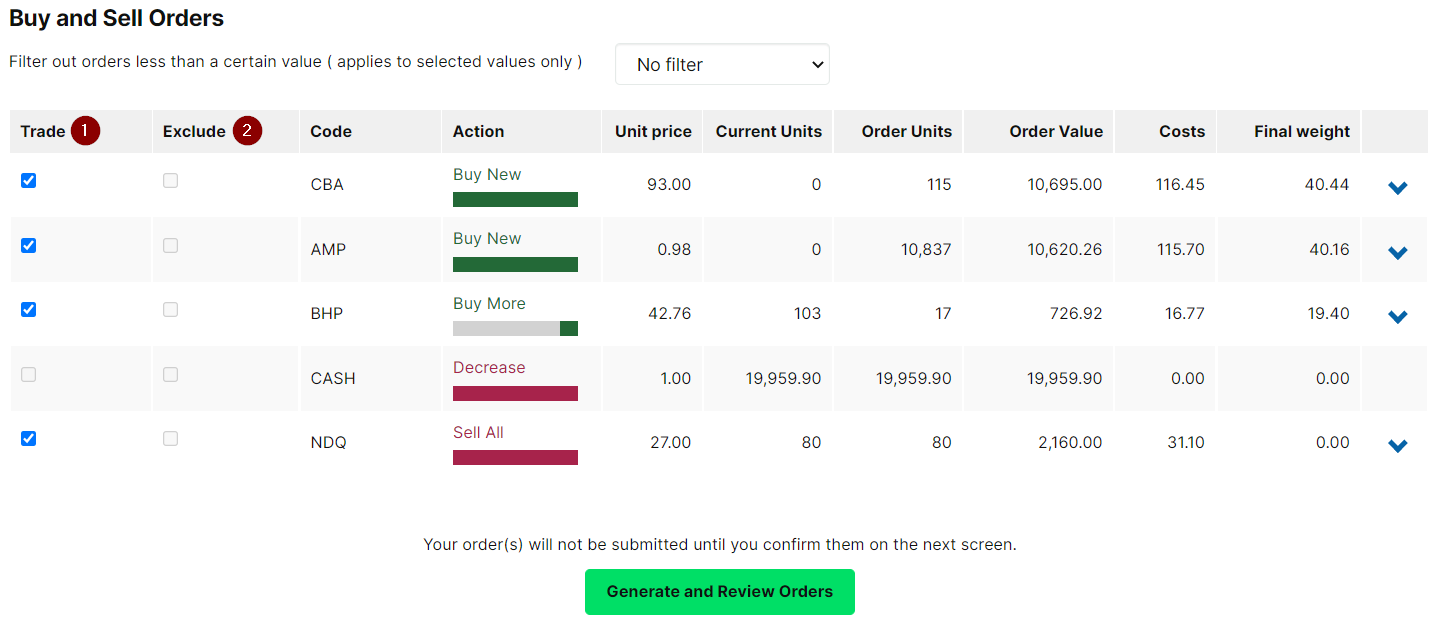

A summary of the resulting buy and sell orders will be shown below. You can exclude particular orders from the alignment by unticking the 'Trade' checkbox (1) and ticking the 'Exclude' checkbox (2).

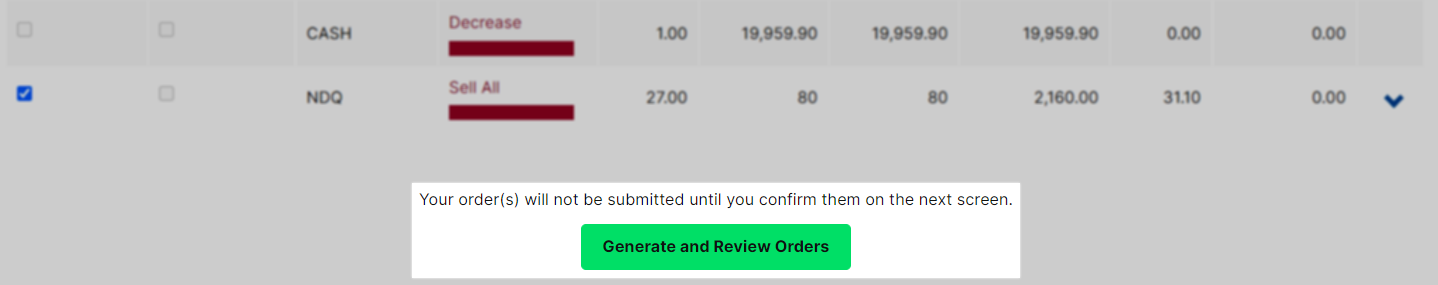

When you're happy with the orders being submitted, click Generate and Review Orders.

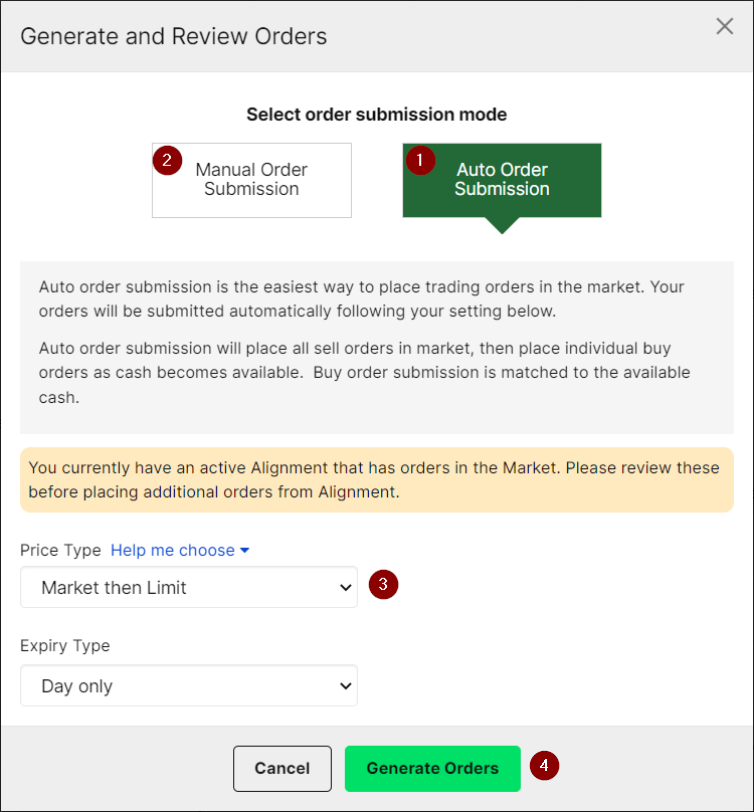

This will bring up the 'Generate and Review Orders' dialog. At the top, you can choose between automatically submitting your orders (1) or generating the orders but submitting them manually (2). Below this, you can choose your 'Price Type' and 'Expiry Type' (3).

For the Auto Order Submission option, we recommend using the Market then Limit price type. This is because Limit orders will be generated with an aggressive limit designed to fill immediately, which may be undesirable. By using the Manual Order Submission option, you can manually edit your limits as required before sending the orders to market.

When ready, click Generate Orders.

If you selected Manual Order Submission, you will need to go to My Orders and click the Not Submitted tab. You can then select each order and review/submit them manually (including changing the limit price if required).

Rebalancing the Client's Portfolio

As time goes on, the weighting of each holding in the client's portfolio will shift as the asset values change.

You can rebalance the client's portfolio to reflect the weighting specified in the model portfolio by again using the 'Portfolio Alignment' tool as outlined in the previous section.

How do I view analysis of my model portfolios?

You can view analysis of your model portfolios to see how they have performed over time, even if they're not assigned to any clients.

To do this, go to the 'Model Portfolios' screen and click on the 'Model Name'.

To bring up analysis, click on the Analysis tab at the top.

The displayed charting provides data on both the historical value and historical performance (calculated daily as the percentage change as of market close) of the portfolio. You can change the period covered by this chart using the date filters at the top. For information on the displayed metrics, you can also click the ( ![]() ) icon in the top-left.

) icon in the top-left.

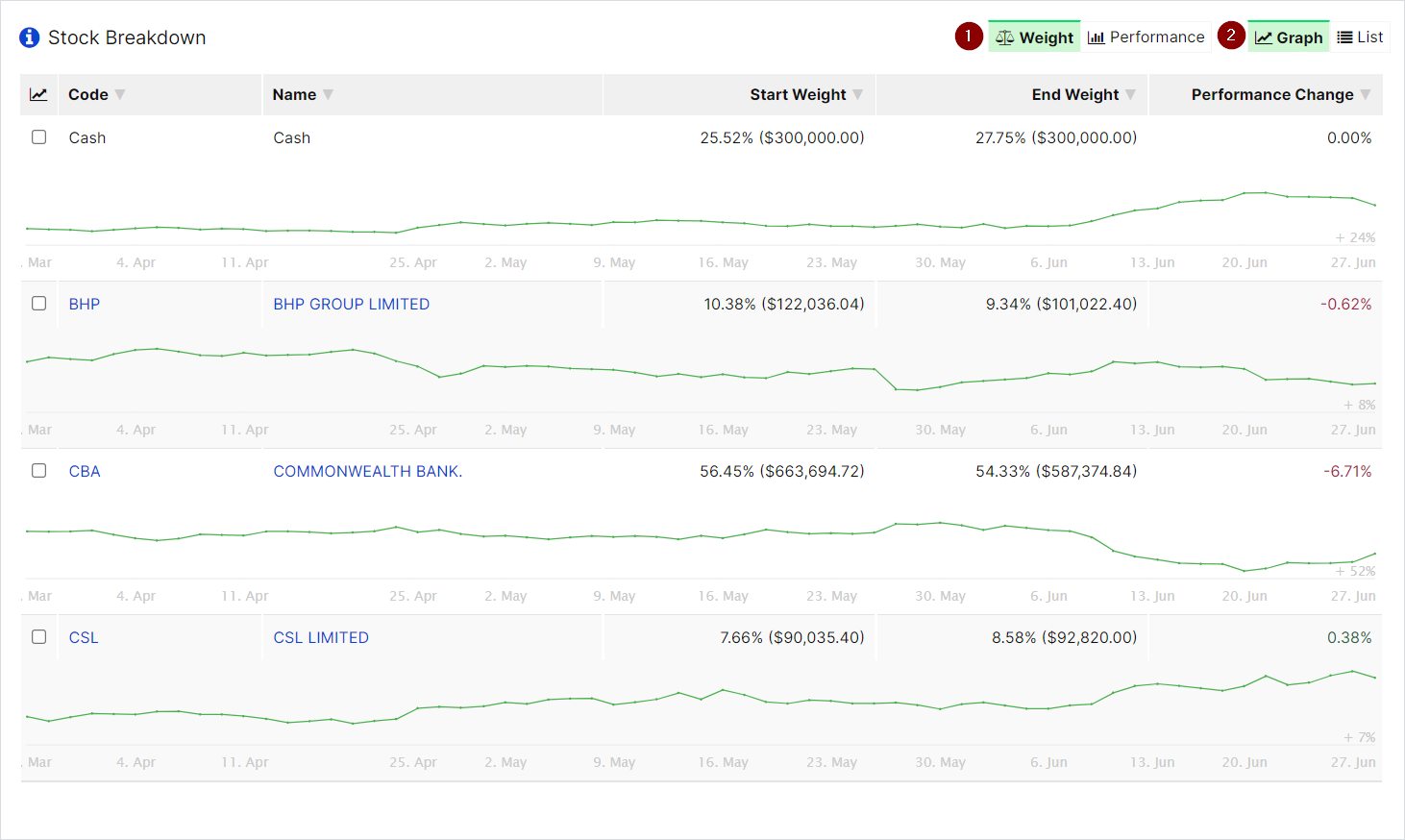

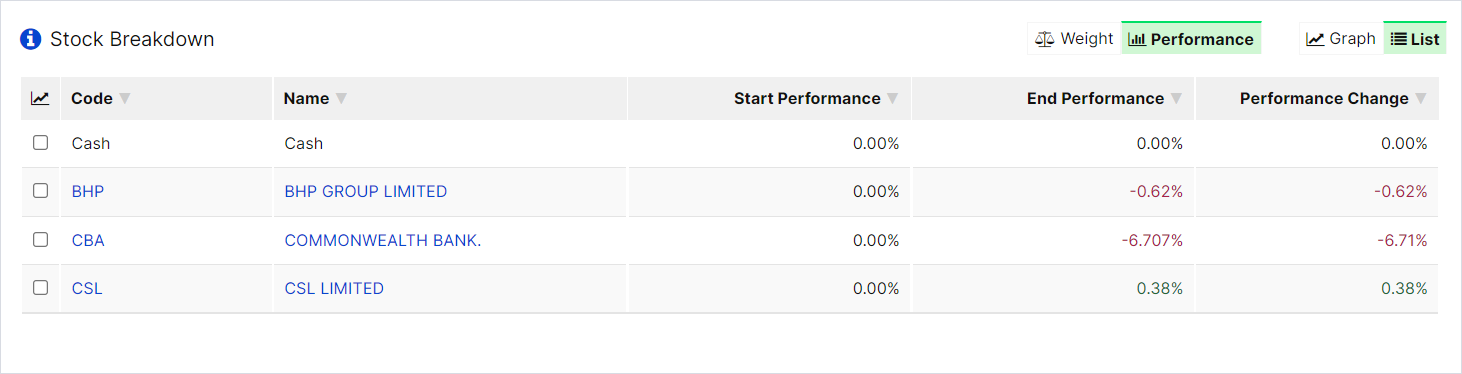

Below the chart, you can view a breakdown of each holding in the model portfolio. Using the buttons at the top, you can display either the weight or performance (1) of each holding as a graph or list (2).